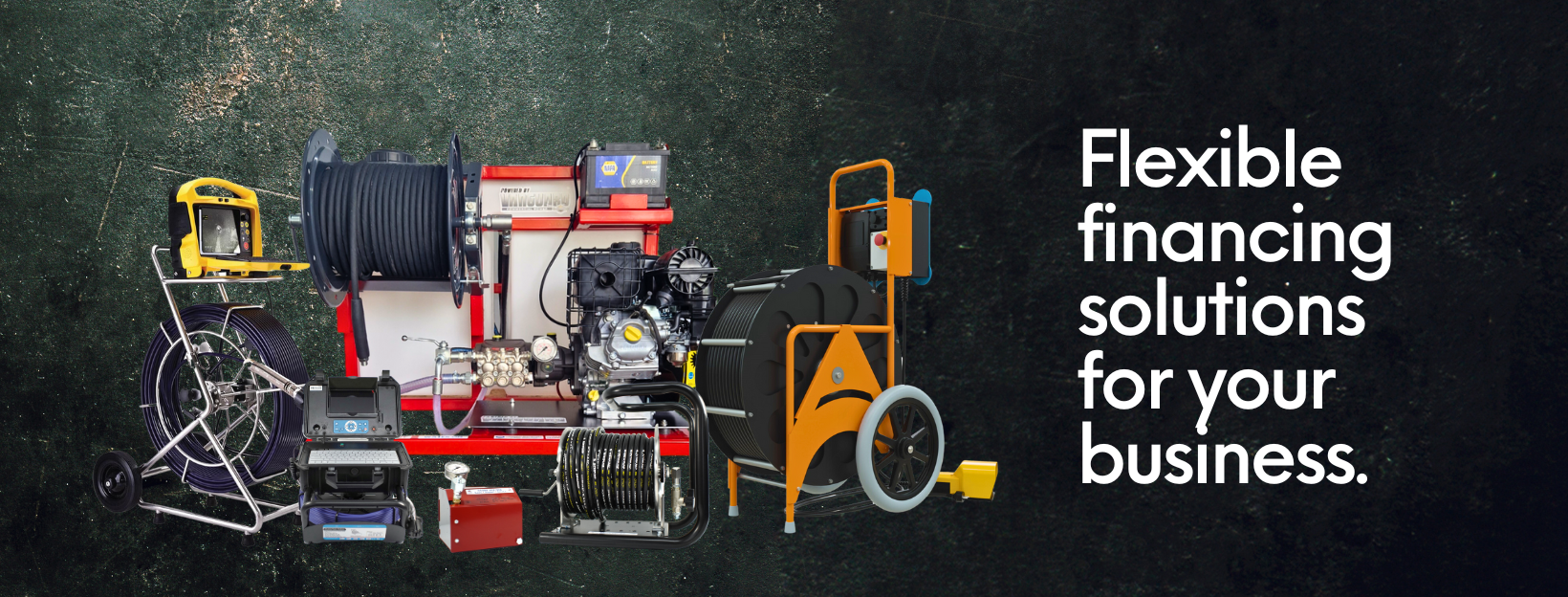

Finance on Drainage Equipment

Financing your drain jetting equipment can be a smart way to spread the cost of your investment and manage your cash flow. Whether you're starting a new business or upgrading your existing equipment, financing provides you with the capital you need to purchase the necessary equipment.

Our financing partners offer flexible repayment options and competitive interest rates, making it easier for you to manage your expenses and keep your business running smoothly. Additionally, our financing options provide tax benefits, making it a cost-effective solution for your business.

It's important to work with a reputable lender who understands your industry and can offer you the right terms and rates for your needs. This is why HCM has carefully selected the best financing partners in the industry.

With the right finance package in place, you can invest in the equipment you need to grow your business.

For more information on our finance packages or to speak to a member of the HCM team:

📞 Call Us: 01928 568 066 📧 Email Us: sales@hcmjetters.co.uk

Business Loans Simplified with iwoca pay

With iwoca pay, you can spread the cost of your purchases over time, giving you more flexibility and control over your finances. The platform offers transparent pricing and no hidden fees, so you can easily see exactly how much you'll be paying and when.

Plus, with a simple and easy-to-use interface, you can manage your payments quickly and efficiently, saving time and reducing the administrative burden. Whether you're a small business looking to improve your cash flow or a larger business seeking more flexible payment options, iwoca pay is a great solution to help you manage your finances with ease.

Finance on Lease

Get the equipment you need to build and grow your business with our pay monthly leasing options. With no balloon payments, zero fees, and low annual costs, you can enjoy a hassle-free experience. We partner with independent business equipment finance brokers who shop around for the best deals.

Leasing is an amazing instrument for businesses to allow them to claim back 100% of their payments against tax. This tax relief can exceed the finance charge, making leasing almost the same as interest-free! Leasing may be the cheapest way to invest in new equipment for your business.

.png)